If you’ve ever walked by a bank, you’ve probably seen an advertisement for free checking. What you might not know, though, is that free accounts are just one of the many account types offered by most banks. Since there are other options that actually cost money, you may wonder what kind of drawbacks are present that would make anyone choose to use paid checking instead of free checking. Before you sign up for a free checking account, it is important that you have a good idea of some of the basic pros and cons of this type of checking.

Pro: The Cost

source: discover.com

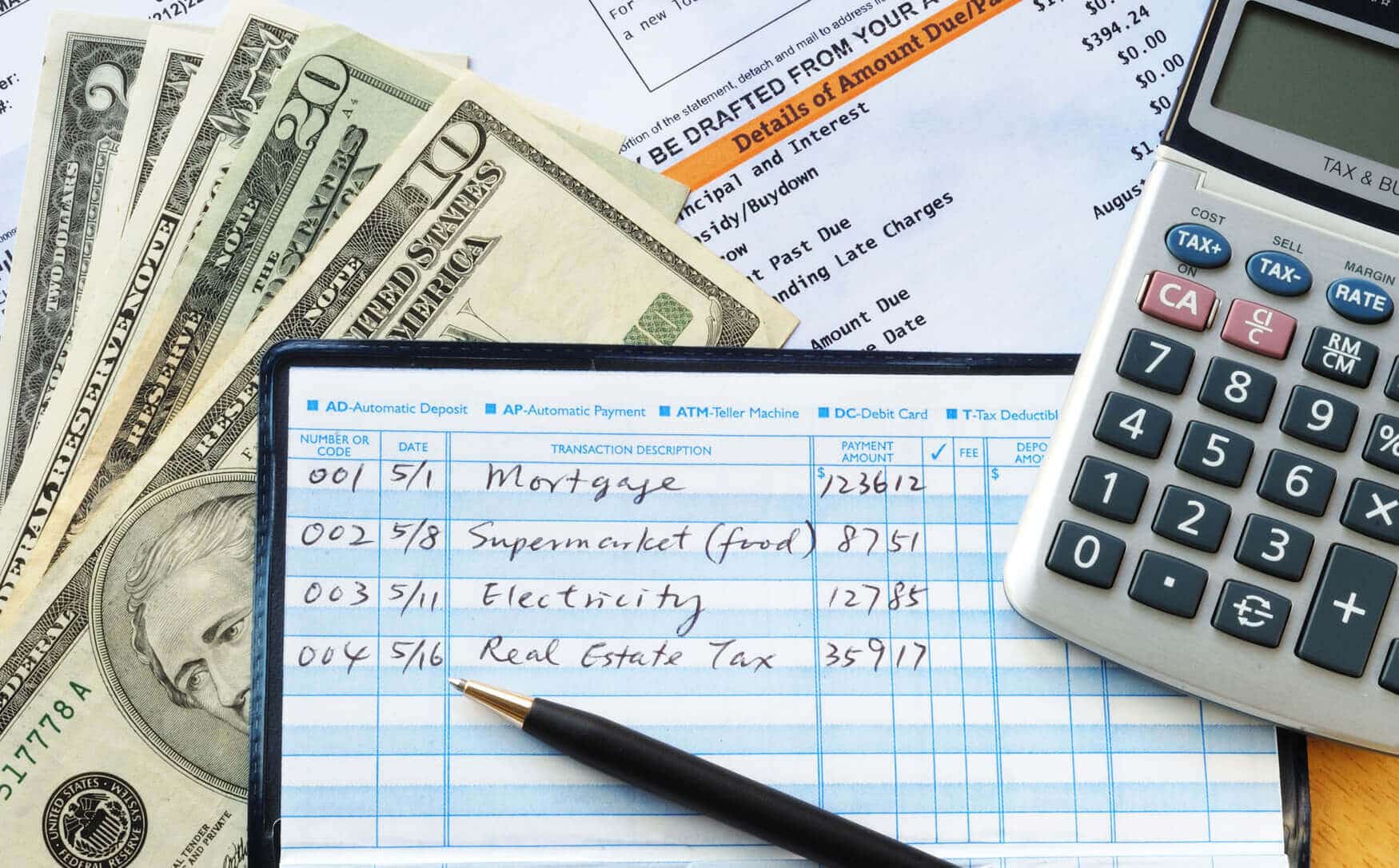

The big benefit of getting free checking is, of course, that it is free. Checking account fees vary from bank to bank but they’ll always cost you more than any free account. This is a great benefit for those who have never used a banking account before or who might be in a tight financial spot, especially when having even a small withdrawal could make it harder to keep a steady budget. If you want to ensure that you’re paying as little as possible to have a bank account, there’s really no other type of account that will work for you.

Con: Feature Free

source: hbc.com

Most free checking accounts are fairly basic in terms of perks. While you might get a good interest rate, you probably won’t get any of the other bells and whistles. If you are opening your first checking account or looking for something simple, this might not be a big deal. If you are expecting a more fully-featured banking experience, though, your free account could leave you feeling a little underwhelmed. A free checking account is usually best for those who are looking for a safe place to keep their money but who have few other extra financial needs.

Pro: A Good Relationship

source: firstbusiness.com

While you may not get all of the features that come with a paid checking account, a free checking account does allow you to become a part of the general ecosystem of the bank with which you sign up. This means that you will get some of the general perks of banking with that organization and that it might be easier to get other products from that bank. Remember, many banks use free accounts as a way to start a relationship with a customer, so do what you can to make sure that the relationship is also beneficial on your end.

Con: Specific Terms

source: waterfordbankna.com

The other big downside to having a free checking account is that you may have to jump through specific hoops in order to keep that account free. Some free accounts, for example, are only free as long as you are a student. Others might require you to make a specific amount of deposits per month or might only let you make a certain number of transactions. While not every free checking account has strings attached, it’s generally a good idea to read the fine print before you sign up.

Is a free checking account right for you? If you understand what you’re getting from the account, it can be a great choice. Take some time to look up the SCCU free checking benefits and to look at your own financial needs before you decide on any specific type of account. If you are comfortable getting something that is lower in price but that might have some specific requirements for staying that way, you might find that a free checking account is the best way for you to keep your money safe.