College is often your first taste of genuine freedom, but it’s also most likely your first step out into the real world. Rent, bills, and groceries are now all expenses that you must manage yourself, and tax adds a whole other layer of complexity to adult life. That’s why we’ve put together this list of things all college students need to know about tax at Live Enhanced. Think of it as your cheat sheet to financial success this EOFY.

Getting A Tax Refund Is Harder Than You May Think

source: insider.com

Some of us were brought up to believe that each year we’re going to get a lovely little bonus back from the taxman somewhere around late July or early August. All we have to do to claim this money is ask nicely, right? Unfortunately, that’s not really how it works, and if you’re not careful, you could even end up with a tax bill.

For this reason, it’s a good idea to have a reputable professional handle your individual tax return. Not only will this ensure you get the maximum amount back, but it will also protect you from making any mistakes that could get you in a spot of trouble.

Keep Receipts

There are certain things that can, and cannot, be claimed at tax time without the receipts to provide proof of purchase. Because this can vary by factors such as the tax year, your industry, and even the total purchase price, we suggest always keeping receipts for anything you intend on claiming. This will help take the stress out of tax time and allow you to focus on other things while your accountant does the hard yards for you.

You Can Claim Some Pretty Surprising Things

source: cloudfront.net

Used your mobile for any income-generating purposes this year? Or perhaps you had to buy a new laptop for that freelancing gig you picked up last break? Well, there’s a chance that you may be able to deduct some, or all, of the cost of these and many other surprising things. This is why it’s always a good idea to seek professional advice when lodging your tax return, especially when you’re new to it.

Any Extra You’ve Put Into Your Retirement Fund May Be Tax-Deductible

If you’re the type who likes to look at the big picture and have already started planning for retirement, you may be able to claim the deposits you make to your retirement fund as tax deductions. Speak to your accountant about your specific situation so they can help you make the most of your forward-thinking.

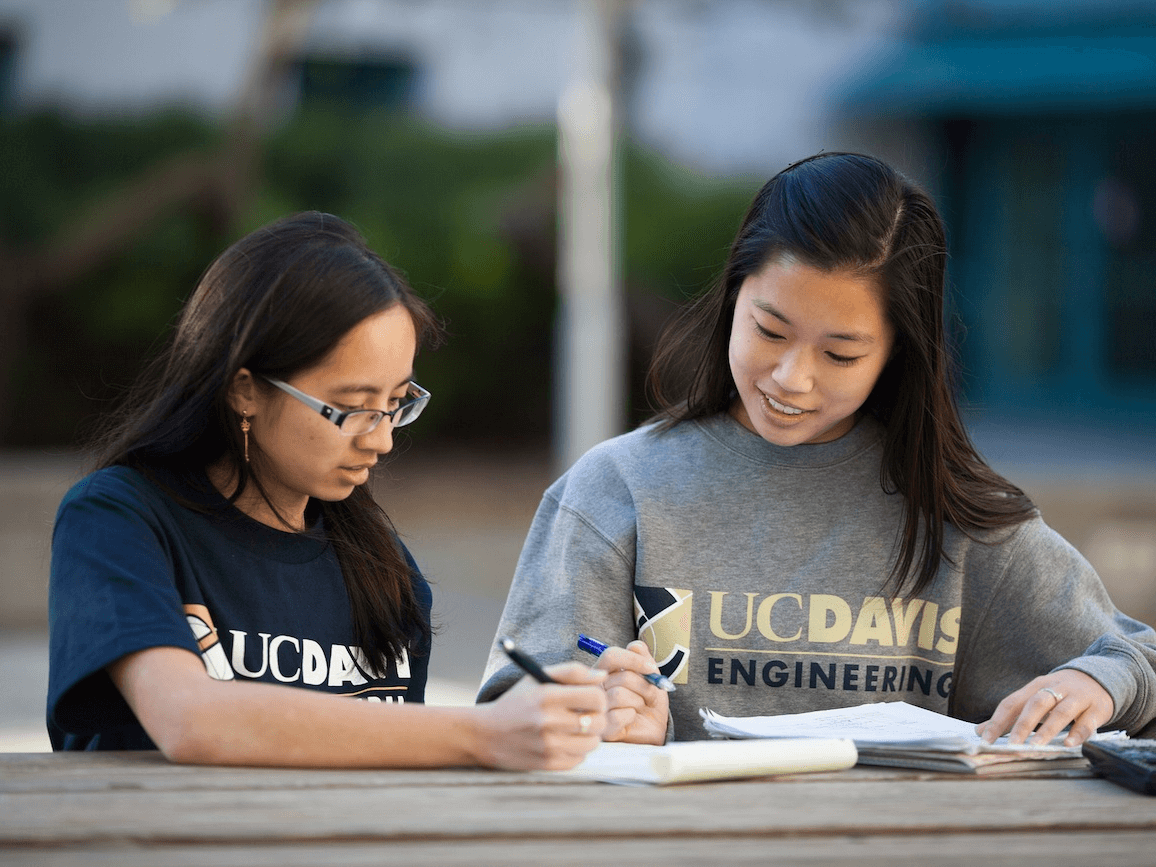

You Need To Report All Sources Of Income

source: bankrate.com

Finally, and this is a big one, all sources of income need to be declared. That means any dividends you’ve made off shares, the money you’ve gotten for any cash-in-hand work, and pretty much anything else that lines your pockets in some way.

Many people, students especially, think that cash income isn’t subject to tax. Unfortunately, that simply isn’t true, and you’ll be in for a whole world of hurt if you get caught out. Trust us, it isn’t worth it.

Tax can be daunting, especially if you’re new to dealing with it and are balancing multiple other responsibilities. While it’s certainly possible to manage your own tax return online, we strongly suggest seeking the help of a professional if you’re feeling uncertain or concerned by the process. You’ll be able to claim the costs of this back next tax cycle anyway, and it’s worth it for your peace of mind. Good luck!