As most of you who are reading this can no doubt relate, saving for rent and bills is no small task. However, “building wealth” is a whole different challenge. It can be hard to work out the steps required to make the extra savings that will change your lifestyle, rather than just provide a slight buffer. We’ve put together a list of practical moves anyone can make to take their money to the next level. Read on below to find out how:

Loan Today, Wealth Tomorrow

source: https://www.hdbfs.com

Time and time again we’ve heard about the dangers of credit cards and the false sense of financial security they can bring. Do you really want to take the risk of trying to handle those high-interest rates and difficult repayment terms? Thankfully, there’s another way. With small, fast cash loans, you can navigate your way through any unforeseen emergency without breaking the bank when the time comes for repayments. Don’t just swap one debt for another. Instead, utilize a low-interest small loan to help you get into the clear and stay there.

Get Started On The Stocks

source: https://theriponadvance.com

Thanks to the financial crisis, many of us grew up believing that the stock market was an unstable, untrustworthy place to put your money. In fact, only 23% of people between the ages of 18 and 37 say it’s a good strategic move for long term investments. However, even in the face of crises, the stock market has a proven track record for the past 90 years of paying off on investments. Is it worth the risk? That’s up to you to decide. One thing’s for sure, with today’s technology, it’s straightforward and effortless to get involved.

There’s An App For That

source: https://www.bankrate.com

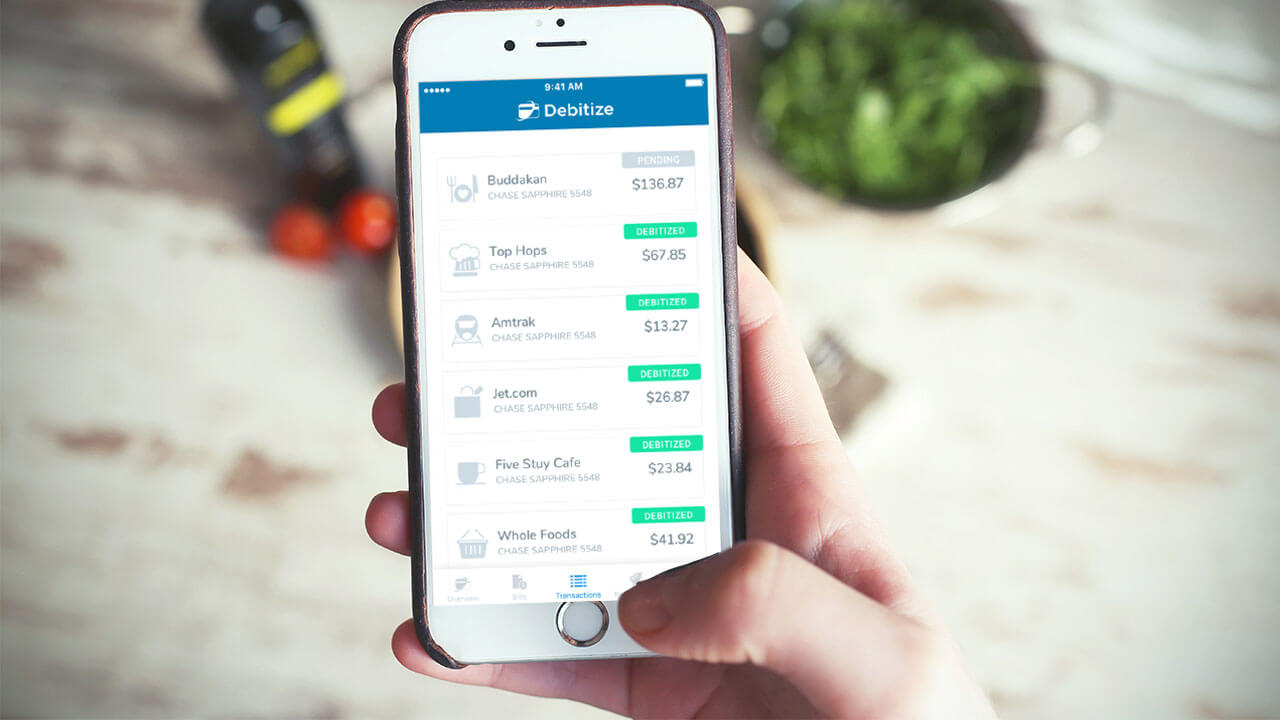

Luckily, thanks to today’s smartphone society, setting up and managing your investment portfolio, budgeting or managing savings is easier than ever. Apps like Acorns, SigFig, Fidelity, and TD Ameritrade have made buying, trading and monitoring stocks an easy task that can be handled during your bathroom break, or when you may have previously been scrolling Instagram just as something to do. Others, like Stock Market Simulator, provide an excellent, risk-free introduction to the stock market without any money being involved. These apps have made it simple for anyone to get involved, without the need of scouring through the finance section of the newspaper or pretending to really know how any of it works.

Increase Your 401k Contributions

source: https://www.fool.com

Having a 401k plan in place is already a great start, but you owe it to yourself to start chipping in a little extra from your salary. You’ll barely notice it now, but it’ll make a world of difference at the end of your working life when the time to withdraw is upon you. Try to get into the habit of increasing your contributions every 6 or so months, or whenever you receive a bonus or raise.

Support System

source: https://inoxcapitals.com

For some reason, too many people believe they need to go through this battle alone. If you buddy up with a friend or a peer, to monitor each other’s progress for saving, you will see considerable differences to the amounts adding up. Too good to be true? Researchers from Harvard, Columbia, and Chile have done the studies to back it up.

So there you have it. Put these steps into work and see how they pay off for you. By doing your research and playing it smart, “pay off” is sure to be a literal one.