In today’s digital age, where documents can be easily manipulated, verifying documents has become easy and safe with the help of AI scanners and OCR technology. It ensures the security and authentication of the document. Whether it is an online transaction receipt, bills, academic certificates, passports, or identification cards, any type of document can be verified by following the KYC and AML processes.

Types of Document Verification Processing

1. Traditional Document Verification:

source: pinterest.com

Traditional verification documents refer to the manual process. They are compared to the referenced samples to check their authenticity. This method involves visual checks, security, printing techniques, and detecting signs of forgery.

Each industry has its own specific requirements for the document verification process to ensure compliance, prevent fraud, and protect sensitive information and data. Government agencies, education institutions, industries, banks, financial institutions, recruitment agencies, and legal service providers verify a variety of documents, including passports, academic reports, pay stubs, financial records, bank statements, contracts, bills, agreements, medical reports, visas, and other legal documents. This is done to detect fraud and ensure that the documents are error-free.

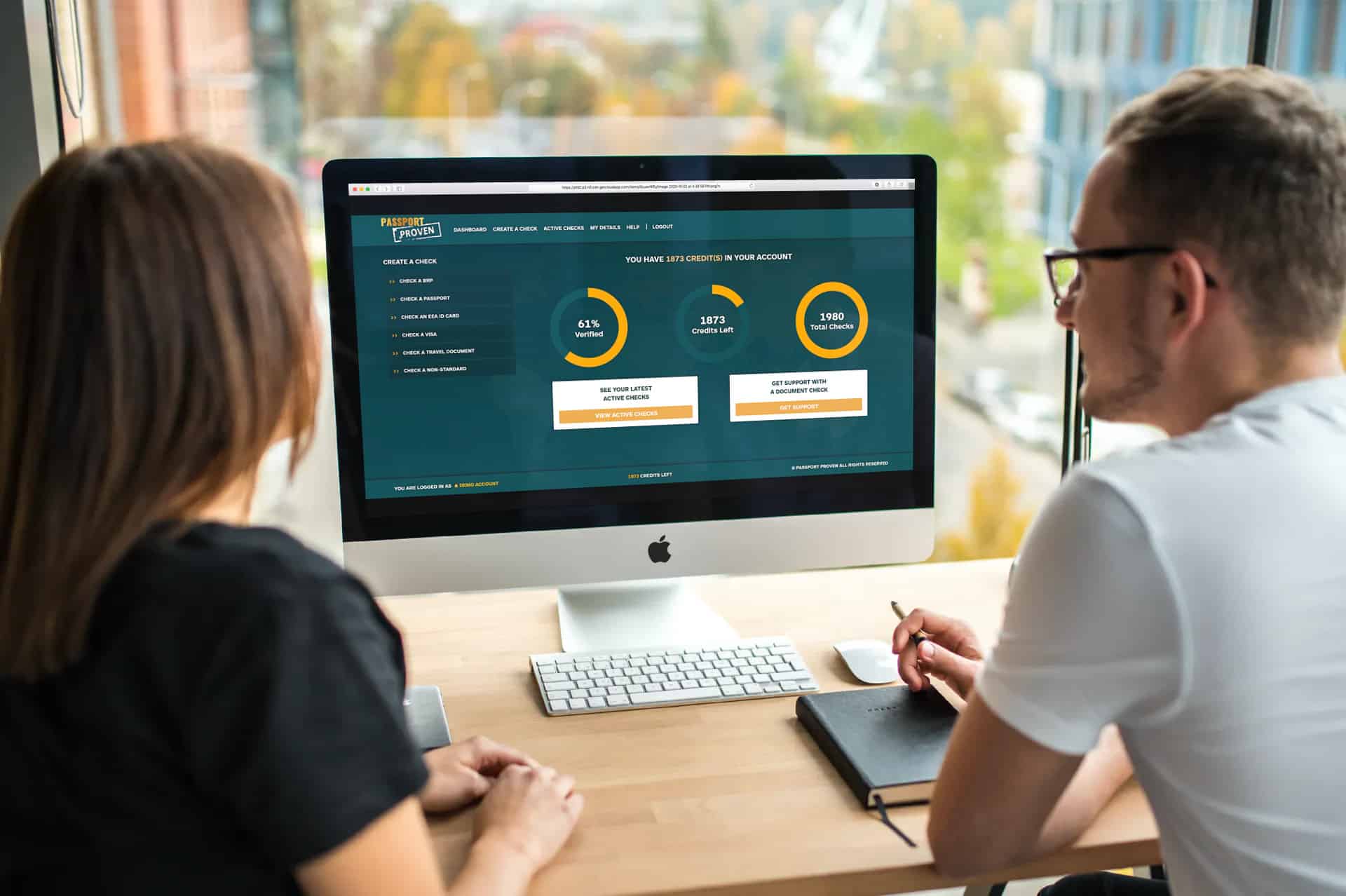

2. Digital Document Verification Process:

source: pinterest.com

The digital document verification process uses technology to verify documents. With the help of an OCR machine, fraudulent activity can be detected. By adopting digital verification solutions, organizations can reduce manual effort, save time, and ensure data accuracy more effectively.

Government sectors, businesses, and other legal organizations use the OCR method to verify documents like transcripts, national identification cards, visas, licenses, diplomas, reference letters, resumes, agreements, patient records, and travel documents. The AI document verification process reduces human error, improves security, and validates the information by performing anti-fraud checks.

The Complete Procedure for Checking Document Verification

With the use of advanced technologies and AI tools, documents can be easily verified. Various industries have significantly enhanced the efficiency, accuracy, and security of documents by using diverse and secure methods to verify documents:

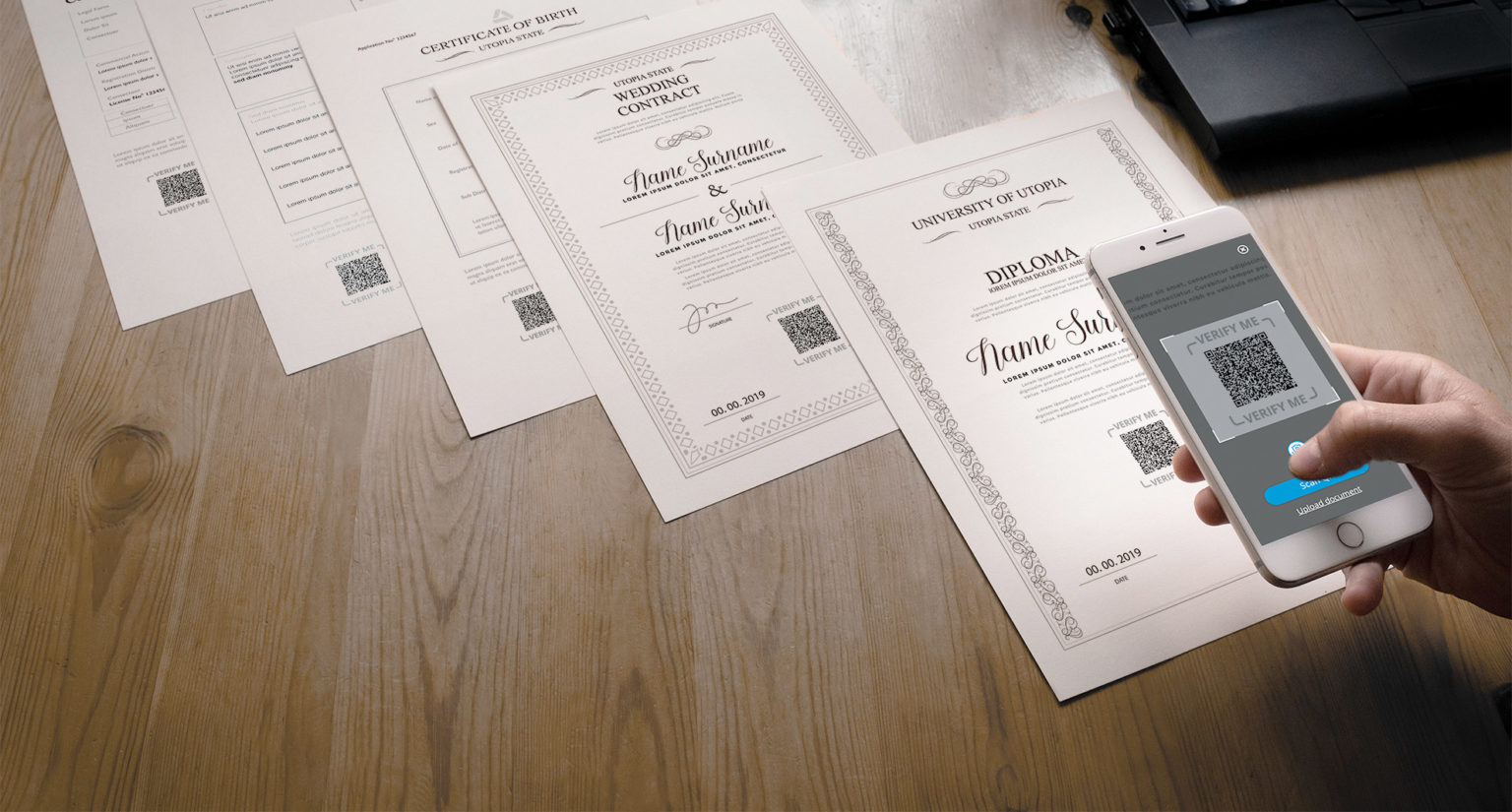

Capture documents: Documents are scanned with a smartphone or camera to verify valid data and images.

source: pinterest.com

Data extraction and validation: Using OCR, required details like dates of birth, addresses, document numbers, and other sensitive details are extracted from the documents to verify.

Anti-fraud checks: These examinations are designed to identify signs of forging, tampering, or manipulation. These checks detect these signs and examine security features and any alterations made to the document.

Decision-making: After document verification, a decision is made regarding the authenticity of the document. It can be automated or manual if requested by the client.

The Value of Document Verification in the Modern Digital Age

With online transactions becoming the new norm, the importance of document verification cannot be inflated. Document verification serves to safeguard, ensure accuracy, and build trust in various contexts.

Various industries and government firms use strict methods to verify documents, such as KYC, AML, and data protection techniques. To enhance security and save reputational damage, AI tools detect forgery, tampering, and alteration. It is done to validate the legitimacy and accuracy of submitted documents. This protects companies from financial losses and regulatory non-compliance.

Advantages of Document Verification Process

source: pinterest.com

The document verification process offers several advantages that enhance security, and efficiency, and build trust and compliance.

Fraud prevention: Document verification detects fraudulent activities, forged data, and manipulated information. Early detection reduces financial and potential losses.

Increase efficiency and enhance security: Identity verification documents help organizations minimize fraud, errors, and theft. This enhances reputation and validates algorithmic allegations. Moreover, these processes save time by handling large volumes of documents more quickly.

Compliance with regulations: Various industries and government sectors use strict anti-fraud methods such as KYC (Know your customer), OCR (Intelligent character recognition), and AML (Anti-money laundering). It prevents penalties and legal consequences.

Improves customer experience: Document checks enhance customer experience by providing a smooth, faster, safer, and more convenient method to authenticate documents. Since physical document submission and manual review are no longer required, It lowers customer effort, resulting in increased customer satisfaction.

Document Verification for All Sizes of Businesses

Document verification is important for businesses of every type and size. It promotes protection against fraud and falsification of documents. Whether it is a small business, medium business, or large enterprise, document verification helps them avoid financial losses and enables regulatory compliances such as KYC and AML, ensuring error-free data. It reduces high risks by utilizing advanced technology and maintaining a trustworthy reputation.

Conclusion

source: pinterest.com

The traditional document verification process is more time-consuming than the digital document verification process. The use of technology makes this process faster and safer. It enables the security and protection of identities and sensitive information. This way, organizations can build up customer trust and satisfaction, and boost their financial terms and data integrity while saving costs, time, and effort.

AI machine document verification is essential for organizations across industries to ensure data integrity, protect sensitive information, and facilitate the transition to digital workflows.